Ready to lift your business to the next level? Xero, a cloud accounting software, is here to transform your accounting to help your business. Its user-friendly layout and powerful capabilities make cloud bookkeeping simple for small and medium enterprises.

As your company grows, so does Xero, automating tasks and improving financial control. This guide will provide you with the essential steps to a hassle-free migration to Xero. You’ll be able to do what matters most—drive your business forward. Let’s unlock the potential of Xero together!

1. When is the suitable time to implement Xero?

Converting to Xero accounting software can significantly streamline your financial control. It is particularly useful when your business evolves and becomes increasingly complex. There are two things to consider in determining the optimal time to implement Xero and start your digital transformation.

New Financial Year for Your Business:

Starting using Xero at a new financial year provides a blank canvas. You can create your accounts from scratch. You can ensure all opening balances are accurate. This setup is your stance in relation to money, for the forthcoming year.

Cut-off Date During Financial Year:

If you wish to change halfway in the financial year, select a convenient cut-off date. It should be consistent with your current accounting procedures. For example, you can take a cut-off date at the start of a new SST period if you are SST registered. Or, if you are not SST registered, you can simply use the present month.

This method allows you to bring over past financial details, such as unbilled sales and bank balances. It makes your books of account consistent.

By applying the most suitable time to your Xero, cloud accounting software in Malaysia, you’ll be able to automate your finance processes and enhance your business performance, especially in e-commerce. Starting to use Xero is a decision that will keep your business running for even more success.

2. Cost of implementation Xero

If you’re considering using the accounting services of Xero for your business, you have to consider the cost of Xero implementation. Here are some things to keep in mind. Also, Xero provides a 30 days free trial to all, try Xero for free before you implement it in your business.

Remember that the Xero mobile app comes with your subscription. This feature allows you to access your accounting anytime and anywhere. It provides convenience and flexibility for managing your finances on the go.

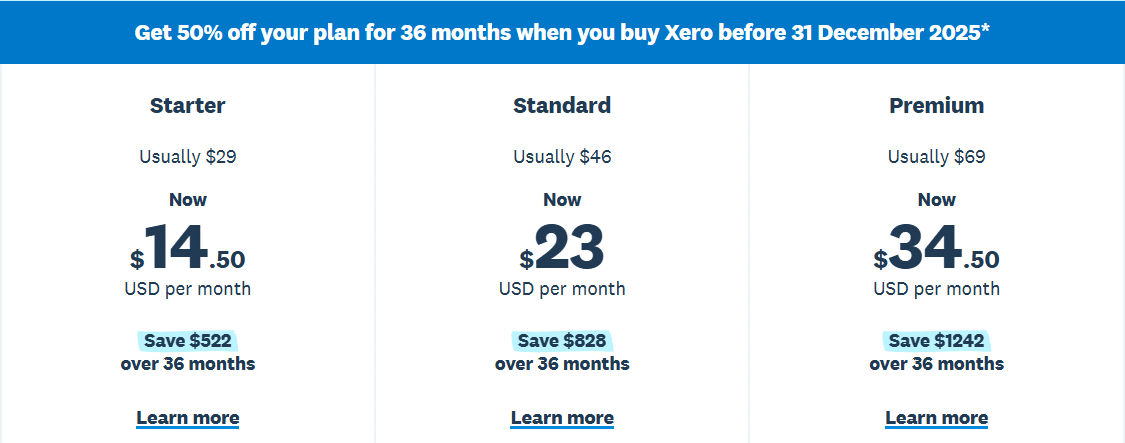

Subscription Fees

Xero is subscription-based. The cost varies based on the plan you select and is around RM130 to RM330 per month (Excluding discounts). Think about what your business needs to get the most value. Learn more about the features of each plan here.